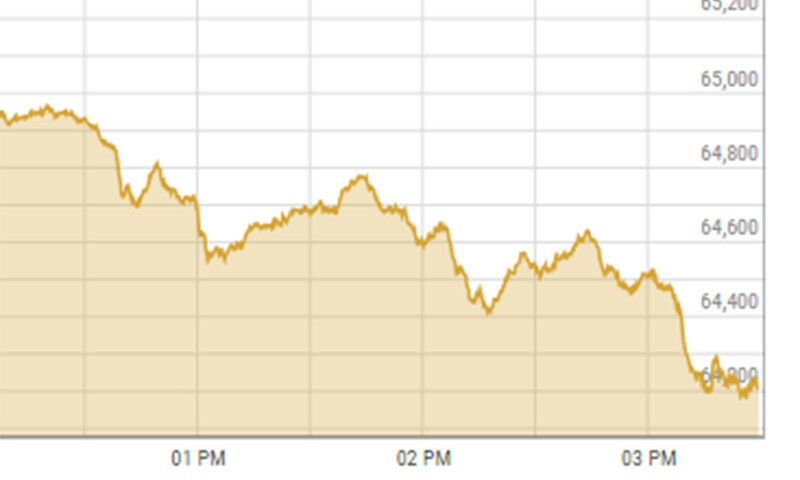

Bears returned to the trading floor of the Pakistan Stock Exchange (PSX) on Thursday as shares traded in the red and lost more than 500 points.

According to the PSX website, the KSE-100 index closed at 64,298 points, down 524.43 or 0.81 per cent, from the previous close of 64,822.43.

The index had previously maintained an upward trajectory on expectations of measures aimed at addressing economic and circular debt issues. A day earlier, the benchmark index briefly crossed the 65,000 milestone during intraday trade.

Today, major activity was witnessed in energy stocks such as the Oil and Gas Development Company (OGDC), K-Electric Limited, Hascol Petroleum Limited and Pakistan Petroleum Limited (PPL).

Speaking to Dawn.com, Mohammed Sohail, chief executive of Topline Securities, said that “confusion in circular debt resolution” impacted the share prices of PPL and OGDC, resulting in the index’s downward trend.

Meanwhile, Yousuf M. Farooq, director of research at Chase Securities, said: “The market experienced increased pressure following the news of revision in the circular debt management plan and a subsequent delay in resolving circular debt.”

This raised concerns among market participants that the circular debt plan might not be executed during the caretaker government’s tenure, he explained.

“With major index weights down and only a few days remaining until the general elections, the market witnessed heightened selling pressure,” Farooq added.

Looking ahead, he continued, the market would be influenced by the upcoming corporate results season, the changing political landscape and the trajectory of interest rates.

Farooq further stated that the political sphere, specifically, served as a wildcard, considering inflationary pressure was expected to ease down over the next year, in addition to expectations of interest rate cuts.

Shahab Farooq, director of research at Next Capital Limited, echoed similar sentiments, saying that uncertainty prompted profit-taking

He added that investors ignored the surprise cut in T-bills cut-off yields, which indicated possible reductions in the interest rate.