Bulls dominated the trade floor on Tuesday as shares at the Pakistan Stock Exchange (PSX) gained over 750 points due to activity reported in the energy sector.

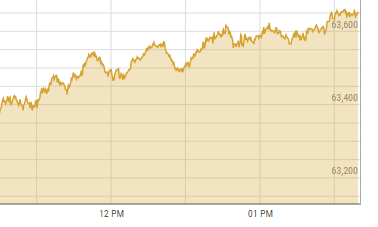

At 1:42pm, the KSE-100 index gained 659.15 points, or 1.05 per cent, to stand at 63,662.06 from the previous close of 63,002.91.

The index closed at 63,799.01, up by 796.10 or 1.26pc, from the previous close.

Mohammed Sohail, chief executive of Topline Securities, attributed the bullish momentum to reports about the energy sector’s circular debt coupled with “pre-election buying”.

Several media outlets have reported that the caretaker government has begun negotiating with the International Monetary Fund (IMF) on proposals for the settlement of circular debt.

Faran Rizvi, head of equity sales at JS Global, said, “The market is likely to experience a rally in the oil and gas sector due to the resolution of the circular debt issue.”

However, he advised caution to investors as the upcoming elections remain a “significant market driver”, urging them to anticipate a “potential short correction before the polls”.

“In the long term, our outlook on the PSX is bullish.” he said.

Awais Ashraf, director of research at Akseer Research, noted that the KSE-100 index rallied on the “probability of resolution of circular debt through one time cash dividend and the likelihood of continuation of electricity at subsidised rate for industries”.

Moreover, he said that the increase in gas prices for Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Pipelines Limited (SNGPL) by the Oil and Gas Regulatory Authority (Ogra) resulted in the positive momentum.

Shahab Farooq, director of research at Next Capital Limited, said that as the government approached the International Monetary Fund (IMF) to greenlight its circular debt reduction plan, it is anticipated that the resolution will eventually lead to big dividends by state-owned exploration and production (E&P) companies.

He noted that the market reacted positively with listed state-owned E&P companies, in addition to other energy sector stocks.

However, he added that other stocks “remained lackluster amid election taking place on Feb 8th.

“Post-election performance of the market is expected to be positive, barring any unforeseen event,” he said.

Tahir Abbas, head of research at Arif Habib Limited, credited the upward trajectory to the “strong corporate results and dividends announcements along with expectations of clearance of energy sector circular debt”.