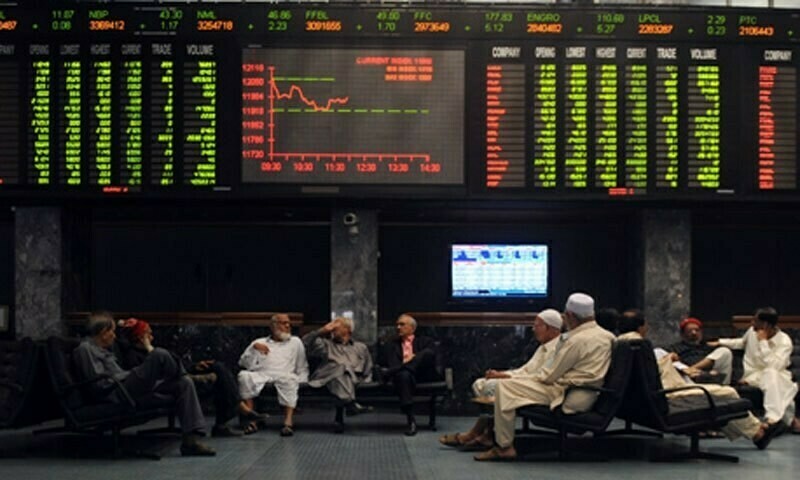

Shares at the Pakistan Stock Exchange (PSX) rallied more than 800 points on Friday, a day after the State Bank of Pakistan (SBP) cut its key policy rate by 200 basis points.

The benchmark KSE-100 index climbed 868.08, or 1.1 per cent, to stand at 79,857.77 points from the previous close of 79,017.61 points at 11am.

Awais Ashraf, director research at AKD Securities, said: “Investors are enthusiastic on meeting all IMF requirements necessary to unlock $7bn Extended Fund Facility and aggressive monetary easing by State Bank of Pakistan in yesterday’s meeting.”

On Thursday, the International Monetary Fund (IMF) confirmed that the Fund’s board will meet on September 25 to discuss the new EFF.

Additionally, the central bank also announced reducing its key policy rate by 200 basis points (bps) to 17.5 per cent from 19.5pc amid demands for a major rate cut.

Yousuf M Farooq, director research at Chase Securities, attributed the rally “on news of the IMF board meeting on the 25th.

“A rate cut of 200bps was higher than market expectations and the market is expecting another rate cut in the next MPS,” Farooq said, however adding that the “FTSE rebalancing and the expectation of foreign selling has kept the rally in check”.

“But — with the expectation of a stabilising economy on the back of a new IMF programme — a broad based upward rerating can be expected in the market over the next year,” he said.

Shahab Farooq, director of research at Next Capital Limited, echoed the same sentiments, attributing the upward momentum to higher than expected cut in policy rate and announcement of date of review by the IMF’s executive board, whose delay had fuelled “concerns and uncertainties”.

“Further positive statements by finance minister and governor state bank confirming a stable external account and downtrend in inflation is likely to improve investor confidence going forward,” he said.

However, he cautioned that the fiscal side remained a concern “with higher chances of a mini budget despite staggering profits of the SBP”.

More to follow