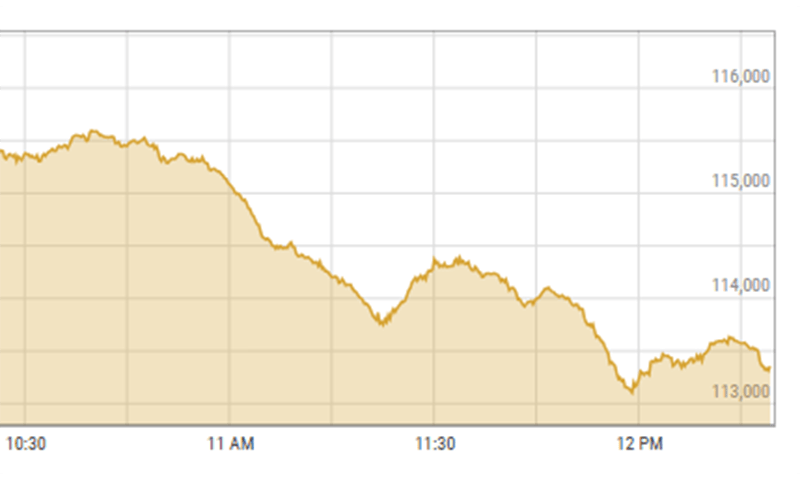

Bears continued to dominate the trade floor on Wednesday at the Pakistan Stock Exchange (PSX) as shares declined by nearly 3,800 points, two days after the State Bank of Pakistan (SBP) cautiously eased the interest rate to 13 per cent.

The benchmark KSE-100 index declined by 3,835.48 points, or 3.34pc, to stand at 111,025.20 points from the previous close of 114,860.68 points at 3:27pm.

Finally, the index closed at 111,070.29, down by 3,790.39 or 3.3pc, from the last close.

Yousuf M. Farooq, research director at Chase Securities, said the market “has paused over the last two days following the SBP’s announcement of a 200bps rate cut, coupled with guidance indicating a likely modest uptick in inflation in the coming months”.

On Monday, SBP had reiterated that core inflation, which stood at 9.7pc, was “proving to be sticky, whereas inflation expectations of consumers and businesses remain volatile”, deciding on a cautious key interest rate cut of 200bps amid demands of a major rate cut.

Expectations for the rate cut varied widely between financial experts and the trade and industry sectors. While businesses demanded a reduction of 400 to 500bps to spur economic growth, financial analysts had predicted a more conservative cut of 200 to 300bps.

Farooq believed that the stock market was transitioning into a more normalised phase, where earnings growth — instead of interest rates and price-to-earning (P/E) expansion — would be the primary driver.

“Retail investors, in our view, should avoid reacting to short-term market fluctuations and instead focus on gradually building diversified portfolios of companies they understand,” he stressed.

Quoting Ramdeo Agarwal, he advised investors to “prioritise quality, growth, longevity, and price (valuation)”.

Awais Ashraf, director research at AKD Securities, attributed the bearish momentum to “concerns over currency depreciation, following yesterday’s data”, which showed the real effective exchange rate (REER) hitting 102, coupled with worries about stock overvaluation.

“We believe strong external flows stemming from robust remittances and exports as reflected in November second highest monthly number amid managed debt payments would dispell concerns about currency stablilty,” he said.

“We believe it is prudent to continue building positions in quality companies that stand to benefit from monetary easing and structural reforms.”

Yesterday, the stock market snapped its record-setting spree as investors indulged in aggressive profit-taking in the post-rate cut session despite hitting an all-time high above 117,000 in intraday trade.