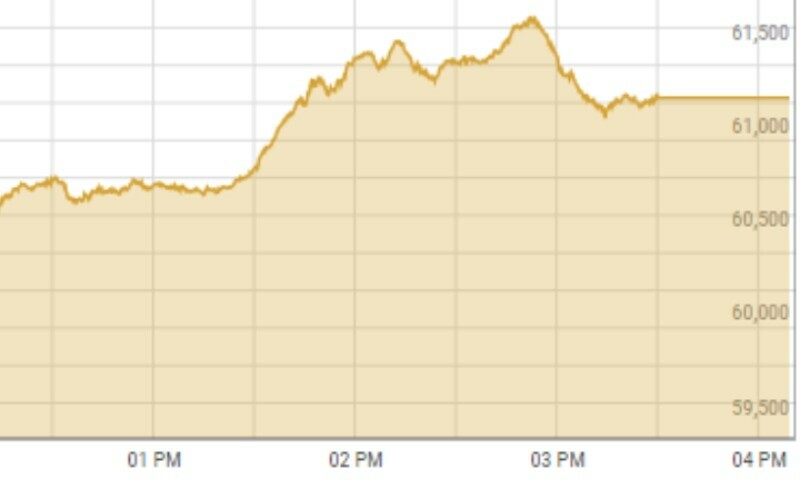

Shares at the Pakistan Stock Exchange recovered their losses from the previous two sessions on Tuesday as the benchmark index gained 161 points.

According to the PSX website, the KSE-100 index was down 1121.24 points, or 1.84 per cent, to stand at 59,944.07 points shortly after trading began. However, after noon, the shares reversed the trend and shed their losses.

The benchmark index finally closed at 61,226.92 points, up 161.61 or 0.26 pc from the previous close of 61,065.31 points.

The market witnessed intense selling pressure during the last two sessions. On Friday, the KSE-100 index had plunged 1,200 points over the delay in announcing the results of general elections, to settle below 63,000.

Yesterday, the PSX witnessed a meltdown as post-election political instability triggered an across-the-board panic selling, which dragged the KSE 100-share index below 61,000, hitting an intraday low at 60,647.68. The index closed at 61,065.32 points after tumbling by 1,878.43 points or 2.98 per cent from the preceding session.

Speaking to Dawn.com, First National Equities Limited Director Amir Shehzad said the market made a recovery today in “technical terms” owing to purchases by financial institutions.

He hoped that the new government would put an end to the downward trend and enable new investors to end the market.

Shehzad added that the share prices of companies had fallen which may lead to increased buying in the near future.

Earlier, Mohammed Sohail, chief executive of Topline Securities, had said the initial downward trajectory was led by Oil and Gas Development Company Ltd (OGDC) and Pakistan Petroleum Ltd (PPL) amid reports the International Monetary Fund (IMF) did not agree with the government’s circular debt reduction plan.

“The market was expecting a big dividend due to this,” he said.

Ahsan Mehanti, an analyst at Arif Habib Ltd, said stocks fell sharply lower on “political noise and reports of IMF disapproval on govt proposals for resolving the circular debt crisis”.

Khurram Schehzad, the chief executive of financial consultancy firm Alpha Beta Core, noted that the PSX had continued its downward trajectory “largely due to uncertainty over the formation of the new government”.

“Historically, the PSX showed jubilance post elections where market used to go up 2-3pc in the first two days post-elections (2008, 2013, 2018 elections),” he said.

“The trend may continue with investor confidence losing further. However sooner a concrete decision is made/announced by the winning political parties, with clarity on an economic team with a plan and direction towards addressing the key challenges, the market should take a sharp recovery,” he said.