Shares at the Pakistan Stock Exchange (PSX) traded in the green on Wednesday over clarity on the political front, gaining more than 900 points.

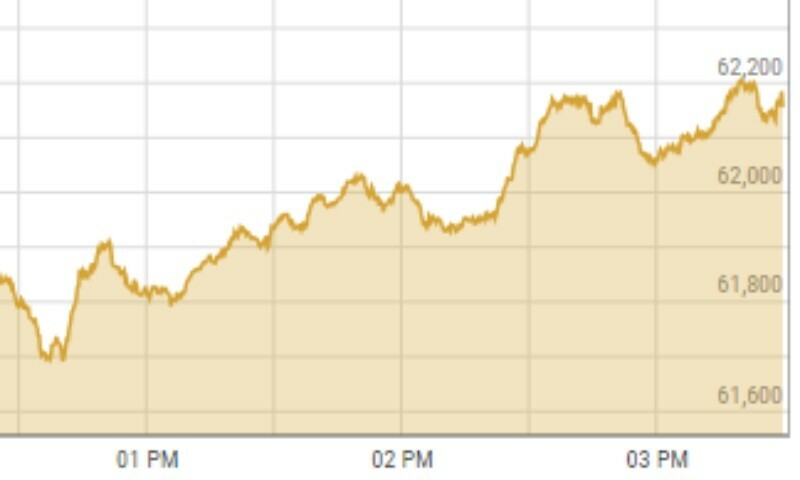

According to the PSX website, the benchmark KSE-100 index gained 1166.11 points, or 1.9 per cent, to stand at 62,393.03 at 10:43am from the previous close of 61,226.92.

It finally closed at 62,153.84 points, up 926.92 or 1.51pc.

On Tuesday, the index had experienced volatility, swinging in both directions before closing in the green as investors had remained unclear on who would form a new government.

Speaking to Dawn.com today, Mohammed Sohail, chief executive of Topline Securities, attributed the index’s upward trajectory to “news of a coalition government being set up”.

Last night, the political leaders of six of the country’s main parties — Istehkam-i-Pakistan Party President Aleem Khan, Balochistan Awami Party leader Sadiq Sanjrani, PML-N President Shehbaz Sharif, Pakistan Muslim League-Quaid chief Chaudhry Shujaat, PPP leader Asif Zardari and Muttahida Qaumi Movement-Pakistan’s Khalid Maqbool Siddiqui — announced their intention to form a government in the Centre and provinces, with Shehbaz being named as the candidate for the prime minister.

Shahab Farooq, director of research at Next Capital Limited, observed that the index “opened on a positive note with the PML-N and the PPP resolving to form a government in the Centre”.

However, he added that uncertainty persisted with “PTI also struggling for the formation of government in the Centre and Punjab”.

The PTI decided on Tuesday to join the Majlis Wahdat-i-Muslimeen to form the government in the Centre and Punjab, and join the Jamaat-i-Islami in Khyber Pakhtunkhwa to get its due share in reserved seats.

Farooq further said that “extreme volatility cannot be ruled out”.

“Besides, there are imminent challenges of economic management for the new government from the very first day of its inception,” he said.

Faran Rizvi, head of equity sales at JS Global, advised investors to adopt a “cautious” approach and invest in high dividend yielding stocks “given the ongoing political uncertainty and the unresolved circular debt issue”.

“These stocks can provide a stable income stream during corrective market phases, offering investors a potential hedge against volatility,” he said.

Yousuf M. Farooq, director of research at Chase Securities, noted that the market opened on a positive note “due to a reduction in political uncertainty, with expectations of the PML-N forming the government”.

He emphasised that the focus would now shift towards the International Monetary Fund’s (IMF) next review.

Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL) “rebounded following rumors of a gas price increase, which could enhance cashflows,” he said.

“A PML-N led government might stimulate activity in construction-related stocks as the economy improves. All attention now turns to the PTI’s actions and negotiations with the IMF,” he observed.