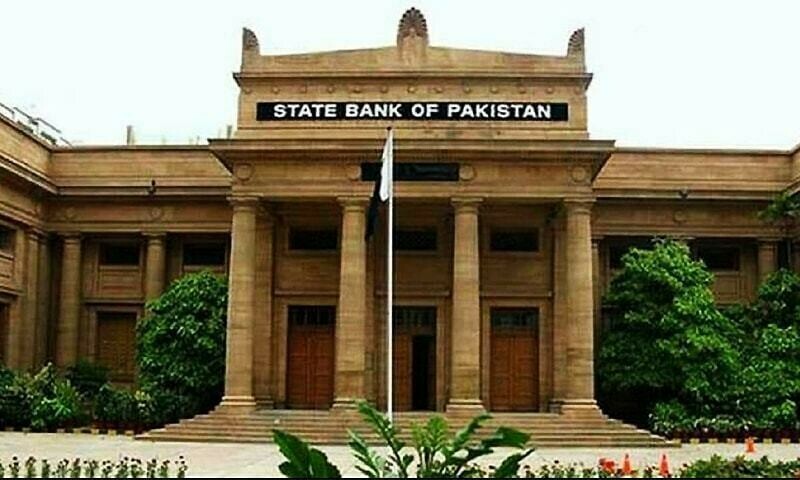

The State Bank’s Monetary Policy Committee (MPC) announced that it has cut its key policy rate by 200 basis points (bps) to 17.5 per cent on Thursday from 19.5pc amid demands for a major rate cut.

“The Monetary Policy Committee (MPC) decided to reduce the policy rate by 200 bps to 17.5 percent in its meeting today,” a statement released by the SBP read, adding that it took into “account various factors impacting the inflation outlook”.

The interest rate decision was being keenly watched by economic stakeholders, with expectations ranging from cautious optimism to demands for significant reductions. While many financial experts predict a modest cut, stakeholders in trade and industry are calling for a much larger reduction to stimulate growth.

Currently, the interest rate stands at 19.5pc, while inflation in August was recorded at 9.6pc, resulting in a positive real interest rate of 10pc. This significant gap has led to calls for a substantial rate cut.

Financial experts generally anticipate a reduction of 150 basis points, with some forecasting a cut of up to 200bps. However, industry leaders are advocating for a more dramatic reduction of 500bps to spur economic growth.

In a poll conducted by Topline Securities, it was noted that 98pc of the participants believed that SBP will announce a rate cut.

“Out of 98pc, 85pc are expecting more than 150bps cut while 15pc are expecting cut between 50-100bps,” it said, adding that the firm was also “of the similar view that SBP will announce rate cut to the extent of 150bps compared to cut of 100bps in last monetary policy meeting”.

AKD Securities, in a note, said, “We expect SBP to cut interest rate by 150bps given the higher real interest rates, the ongoing disinflationary trend and weak economic activity.”

Throughout the financial year FY24, the SBP maintained the interest rate at a high of 22pc. In recent months, it introduced two consecutive cuts — 150bps initially, followed by a 100bps reduction — bringing the total decrease to 2.5 percentage points.

Despite these adjustments, the gap between inflation and the interest rate has fuelled further demands from the private sector.

The government has repeatedly stated that the recently secured $7 billion loan from the International Monetary Fund (IMF) would be the last, provided all IMF conditions are met in time.

Financial experts believe these statements from the Ministry of Finance indicate that the upcoming rate cut is likely to remain below expectations, with the SBP aiming for a reduction of no more than 200bps to maintain a buffer against inflation.

The central bank faced challenges earlier this year, as inflation surged to 38pc despite a series of interest rate hikes. However, a sharp decline in inflation over the past three months has created an opportunity for the government to inject liquidity into the private sector and boost economic growth.

The projected growth rate for the current fiscal year (FY25) is 3.5pc, up from 2.4pc in FY24. Experts believe that reducing the cost of borrowing will encourage private sector investment, stimulate economic activity and create much-needed jobs, particularly for young Pakistanis seeking opportunities abroad.