Shares at the Pakistan Stock Exchange (PSX) bounced back in style on Wednesday, climbing more than 4,600 points and posting its highest-ever single-day gain, just a day after it witnessed a massive sell-off due to political unrest.

The bourse’s remarkable turnaround was made possible by the conclusion of street confrontations between PTI protestors and law enforcement agencies in Islamabad following a grand operation by the latter.

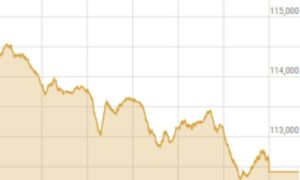

The benchmark KSE-100 climbed 3275.22 points, or 3.46 per cent, to stand at 97,849.38 points from the previous close of 94,574.16 at 9:43am. By 1pm, the index increased by 3702.62 points to stand at 98,276.78 points.

By the end of the trade session, the index had surged 4695.09 points, or 4.96pc, to stand at 99,269.25, nearing the 100,000 milestone.

Mohammed Sohail, chief executive of Topline Securities, said that the stock at the stock exchange were recovering after concerns regarding PTI’s protest dissipated.

He added, “KSE-100 Index rebounds sharply, jumping 4,695 points (4.96pc) to close at 99,269 — marking the highest single-day rise, just a day after its largest drop.”

Yousuf M. Farooq, director research at Chase Securities, stated, “The market is recovering from a sharp correction as the government has successfully dispersed crowds in Islamabad.”

He added that attention had “shifted back to declining interest rates and earnings growth”.

“Meezan Bank opened under some pressure following the State Bank of Pakistan’s implementation of a Minimum Deposit Rate for Islamic banks,” he highlighted, adding that retail investors “should look beyond short-term fluctuations and focus on long-term investment strategies, understanding that they are purchasing shares in well-established Pakistani companies with a track record of gradually growing earnings and payouts”.

Awais Ashraf, director research at AKD Securities, echoed the same sentiments. He said that the dimming political turmoil “rejuvenated investor confidence, supported by improving macroeconomic indicators”.

“Equities are expected to maintain a bullish trend, driven by declining fixed-income yields and subdued commodity prices,” he highlighted, adding that index remained “notably undervalued compared to its historical averages and regional counterparts”.