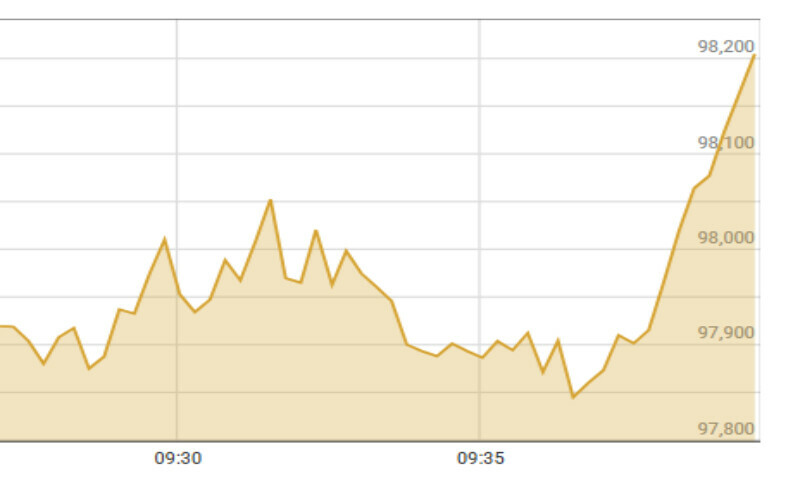

In a record-setting spree, bulls propelled shares at the Pakistan Stock Exchange above the 98,000 mark on Friday as share prices surged more than 2,000 points in intraday trade.

The benchmark KSE-100 index climbed 1158.13 points, or 1.19 per cent, to stand at 98,486.52 points from the previous close of 97,328.39 points at 9:50am. At 11:10am, the index surged 2057.40 points to stand at 99,385.79 points from the last close. Finally, the index closed at 97,798.23, up by 469.84 points or 0.48pc, from the last close.

Awais Ashraf, director research at AKD Securities, said, “Subsiding political risk, combined with robust institutional interest driven by easing interest rates, has supported the index’s continued strong performance.”

He observed that the market at present was trading at an appealing price-to-earnings (P/E) ratio of 4.7x, which suggested a potential upside of at least 55pc if it reverted to its 10-year average of 7.2x.

“Furthermore, it provides an attractive dividend yield of 10.5pc,” he added.

Yousuf M. Farooq, director research at Chase Securities, stated: “There have been media reports about the army chief’s discussions with businessmen, during which he reassured the business community of both economic and political stability.”

“Over the past few weeks, political risk has been the primary concern in economic discussions,” he observed, noting that the “perceived reduction in political risk is believed to have driven liquidity into the stock market over the past two days”.

“Retail investors are advised to disregard short-term market fluctuations and adopt a long-term strategy by consistently investing small amounts of their savings each month in a diversified portfolio of companies they understand,” he recommended.

Sana Tawfik, head of research at Arif Habib Limited, attributed the bull run to positive macro economics indicators, with inflation expected to be between 4.5pc to 5pc in November — a low which was last witnessed in April 2018 when it had clocked-in around 3.96pc.

Additionally, she said that the positive momentum was maintained by a current account surplus, along with “institutions and mutual funds buying”.

Lately, shares at PSX have witnessed multiple record-highs, which analysts have attributed to stabilising macroeconomic indicators — with inflation expected to be between 5pc to 6pc in November, which has also raised market expectations of another rate cut.

Yesterday, the rally was particularly driven by the unlocking of Fauji Fertiliser Company (FFC) and Fauji Fertiliser Bin Qasim Limited (FFBL) dividends which overshadowed political concerns.

“While individuals remain cautious due to prevailing political uncertainty, institutions are actively building equity portfolios, encouraged by declining fixed-income yields and growing confidence in the macroeconomic outlook,” one analyst had highlighted.

Previously, analysts had observed that stocks were no longer as cheap as they were last year but remained reasonably priced, propelled by stabilising macroeconomic conditions.

However, they still warn that major risks to the momentum included “political instability, macroeconomic shocks, excessive government spending, and a deteriorating current account position”.

More to follow