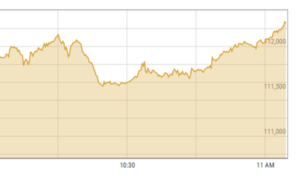

Shares at the Pakistan Stock Exchange (PSX) traded in the green on Monday, gaining over 900 points in intraday trade, with the analysts attributing the ongoing trend to clarity on the government structure.

The KSE-100 index gained 904.03, or 1.44 per cent, to stand at 63,719.84 at 1:03pm from the previous close of 62,815.81.

Mohammed Sohail, chief executive of Topline Securities, credited the rally to “clarity on the new government structure”.

Tahir Abbas, head of research at Arif Habib Limited, also credited the “clarity on the political front regarding formation of the new government” for the upward movement, but highlighted that “robust results announcement” boosted investor confidence.

He said the investors will continue to closely monitor the economic roadmap of the newly elected government, including the new International Monetary Fund (IMF) programme coupled with the new budget.

Faran Rizvi, head of equity sales at JS Global, observed that “the resistance level for short-term traders” stood at 63,200 points.

He warned that the market might experience a “minor correction from this level”.

Rizvi said factors such as political stability and the inflation cycle will play a crucial role “in driving the market upward”.

However, he said that the indicators suggested “positive prospects for long-term macroeconomic growth”.

Yousuf M. Farooq, director of research at Chase Securities, echoed the same sentiments. He attributed the rally to “improved clarity on the political front”, in addition to “cheap valuations and the anticipation of a strong corporate results season”.

He added that the current account remained relatively under control, despite turning red in January, highlighting that the market participants anticipated a “significant interest rate cut over the next year”.

“Lower interest rates later this year would make stocks more attractive given the projected growth in earnings and dividends, alongside the expectations of increased consumer demand as the economy recovers,” he said.

He observed that expectations of a deal with the IMF also increased stability, although he cautioned that “hiccups in the next IMF deal remained a key risk for the economy and the stock market”.