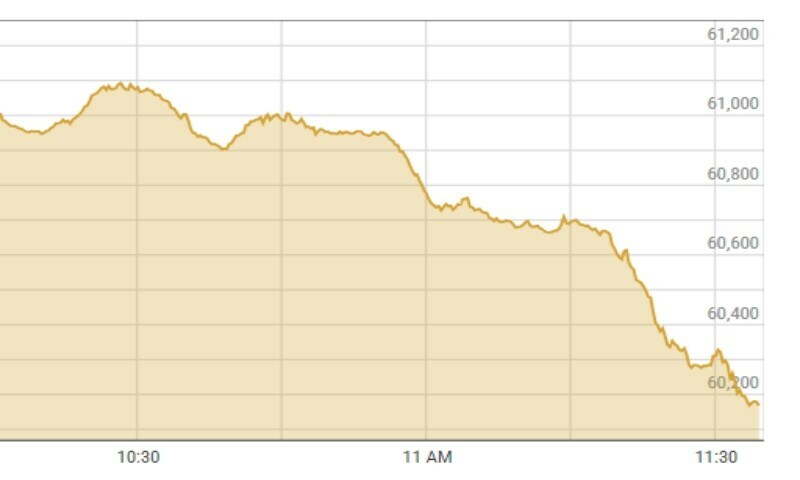

Shares at the Pakistan Stock Exchange (PSX) traded in the red on Friday as stocks plunged by more than 900 points in intraday trade as analysts attributed the losses to uncertainty on the political front.

At 12:09pm, the benchmark KSE-100 index plunged by 984.38, or 1.61 per cent, to stand at 60,035.67 from the previous close of 61,020.05 points.

On Thursday, the bears took over the trading floor of the PSX after the PTI nominated candidates for prime minister and Punjab chief minister and started contacts with different parties for the formation of a coalition governments.

Also, the PPP’s reluctance to join PML-N leader Shehbaz Sharif’s cabinet despite announcing support to elect him as prime minister drew strong reactions from the PML-N camp, deepening political uncertainty due to which the benchmark index came under selling pressure wiping out overnight gains.

Speaking to Dawn.com, Mohammed Sohail, chief executive of Topline Securities, attributed today’s bearish momentum to “uncertainty over the formation of a new coalition” which forced leveraged players to trim their position.

Awais Ashraf, director of research at Akseer Research, said that the expected formation of a “weak coalition government in the Centre” and calls of protest from the PTI and other parties has raised questions on the implementation of tough reforms needed for economic recovery.

“Subsequently, state-owned entities remained under pressure and dragged the KSE-100 index into negative territory.” he added.

Yousuf M. Farooq, director of research at Chase Securities, noted that Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL) experienced selling pressure due to a delay in the circular debt resolution, in addition to political uncertainty.

It should be mentioned that the interim government on Thursday allowed another 45 per cent increase in natural gas prices to oblige the International Monetary Fund (IMF) and meet revenue requirement of the gas utilities targeted for the current year.

Farooq further said that the gas price hike made market participants concerned about inflationary pressure.