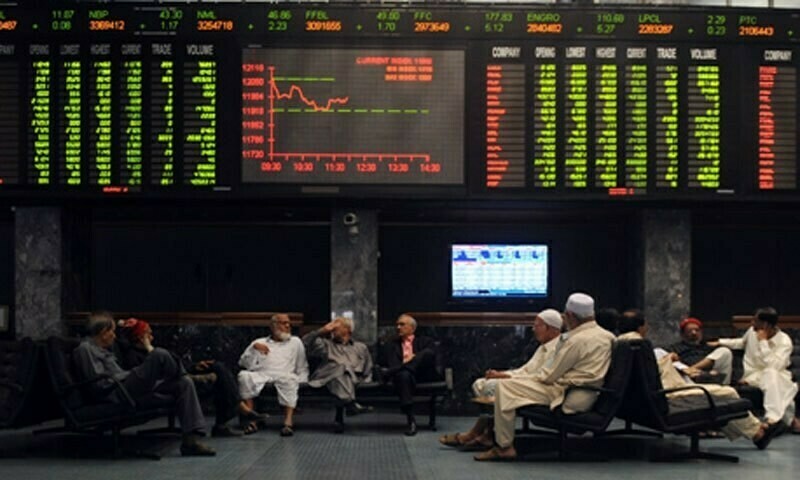

Shares at the Pakistan Stock Exchange (PSX) climbed more than 400 points in intraday trade on Thursday, which one analyst attributed to the Moody’s rating upgrade which influenced investor sentiment.

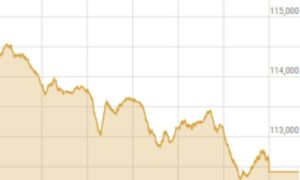

The benchmark KSE-100 index climbed 421.02 points, or 0.54 per cent, to stand at 78,413.80 points from the previous close of 77,992.78 points at 10:41am.

Awais Ashraf, director research at AKD securities, attributed the trajectory to “Moody’s rating upgrade, due to improved external liquidity positions, has positively influenced investor sentiment and eased concerns about the delayed IMF board approval”.

On Wednesday, global ratings agency Moody’s upgraded Pakistan’s local and foreign currency issuer and senior unsecured debt ratings to Caa2 from Caa3, saying its decision to upgrade was due to “Pakistan’s improving macroeconomic conditions and moderately better government liquidity and external positions, from very weak levels”.

Yousuf M. Farooq, director research at Chase Securites, noted, “The KSE-100 has remained under pressure during the past few weeks on uncertainty of the timing of the IMF programme.”

“We believe that that Pakistan will be able to rollover its debt or arrange additional debt from foreign banks even if it is at a higher cost,” he said.

The government and the IMF agreed on the 37-month loan programme in July which, according to the fund, was subject to approval from its executive board and obtaining “timely confirmation of necessary financing assurances from Pakistan’s development and bilateral partners”.

“The market is now cheap when compared to the 10-year bond yield which is now yielding 1.5pc below the earnings yield of the 100 index and the index we believe will eventually adjust to incorporate lower risk-free rate,” Farooq said.

He noted that the market now awaits clarity on the IMF programme, adding that “over the last 10 years, the average earnings yield of the index has been 0.17pc lower than the 10-year risk-free rate”.

More to follow