THE decision to significantly revise down buyback prices at which power distribution companies purchase electricity from rooftop solar system owners is the correct step towards energy price equity for all consumers.

Under the revised net-metering policy, distribution companies will buy unused surplus solar electricity from net-metered consumers at Rs10 per unit, down by nearly 63pc from Rs27, during the day while selling grid power to them for Rs42 during off-peak hours, and Rs48 during peak hours (the prices are ‘net of applicable taxes’) or at the applicable rates being paid by households connected to the national grid. The revised tariffs will apply to new distributed solar or net-metered consumers; existing beneficiaries will shift under this framework after the expiry of their seven-year contracts. Besides, net-metered consumers would no longer be allowed to instal solar capacity exceeding their sanctioned load, except for a 10pc cushion, compared to the current 50pc margin.

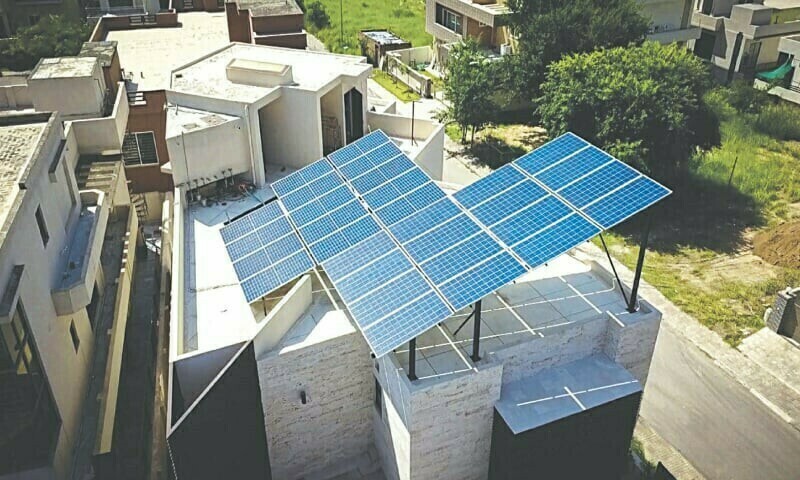

The revisions became necessary due to three factors. One, most rooftop solar power owners have installed far more surplus solar power than they need for self-consumption. This helps them export surplus electrons to the grid during the day, and import them after sunset. Surplus electrons exported to distribution firms in winter are often reclaimed in summer. It amounts to using the grid as a big storage battery while avoiding payment of capacity charges and transmission costs on electricity consumption.

Second, affluent urban net-metered households are causing a nine-paisa per unit impact on average electricity cost which, the energy ministry says, could increase to Rs3.6 by 2034 if the policy is not changed. By the end of December 2024, the existing 283,000 rooftop solar owners had already transferred the burden of Rs159bn to those dependent on grid power. Third, there are valid concerns that higher penetration of distributed solar could put the infrastructure at risk of failure since most net-metered surplus loads are concentrated in larger cities where rapid capacity expansion might compromise supply stability.

It is but natural that the changes in the distributed solar policy, leading to the reduction in buyback rates, and the shift to net billing from net metering, have come under criticism. But the opprobrium generated by the policy revisions are misplaced because these will increase the payback periods for consumers who have installed or planned to instal oversized solar systems. The falling solar panel and equipment prices will keep the payback period short despite tighter net-metering conditions, at least for those who have just enough capacity for self-consumption despite the changes in the tariff structure for distributed solar. Some may argue that the alterations in incentives will discourage rooftop solarisation, but that is unlikely because solar power is still cheaper than the grid and becoming more cost-effective as technology improves.

Published in Dawn, March 15th, 2025