KARACHI:

Workers’ remittances recorded a significant inflow of $3.1 billion during December 2024, marking a year-on-year (YoY) growth of 29.3% and a month-on-month (MoM) increase of 5.6%, according to the State Bank of Pakistan (SBP).

Cumulatively, remittances reached an impressive $17.8 billion during the first half of FY25 (H1FY25), reflecting a 32.8% rise compared to $13.4 billion received in H1FY24.

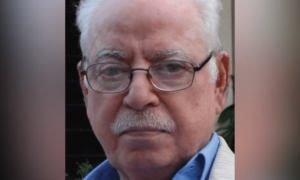

Speaking to The Express Tribune, Ali Najib, Head of Equity Sales at Insight Securities, said, “We expect remittances to exceed $35 billion by the end of this year.”

The primary sources of remittances in December 2024 were Saudi Arabia at $770.6 million, the United Arab Emirates (UAE) sending $631.5 million, the United Kingdom issuing $456.9 million, and the United States of America sending $284.3 million, according to SBP.

Najib attributed this remarkable surge in remittances to three key factors: narrowing the black market and interbank gap, stabilising the rupee against the dollar, and the robust performance of the Pakistan Stock Exchange (PSX).

The Special Investment Facilitation Council (SIFC) implemented administrative measures to minimise the difference between the black market and interbank exchange rates, encouraging formal remittance inflows, he said. A stable rupee, with a 1% appreciation against the US dollar in 2024, and the SBP’s efforts to build foreign exchange reserves (now standing at $11.7 billion), reduced speculative activity. By curbing boom-bust cycles, this policy incentivised the diaspora to send remittances through formal channels.

He added that the PSX emerged as one of the top-performing markets, further boosting investor confidence.

Najib projected a consistent remittance run rate of $3 billion per month from January to June 2025, potentially driving total inflows to exceed $35 billion by the end of FY25an increase of 35% compared to the previous fiscal year, which saw a 29% rise.

Zafar Paracha, Chairman of the Exchange Companies Association of Pakistan (ECAP), highlighted that enhanced control over leakages has significantly boosted remittances. Efforts to regulate the open and grey markets have been instrumental in improving formal remittance inflows.

Administrative measures implemented by the interim government and maintained by subsequent administrations have begun yielding results, particularly in curbing the smuggling of goods and currency by border mobs, which previously undermined remittances. Tightened immigration policies and improved documentation have further contributed to this positive trend, he said.

The government has effectively controlled the disparity in dollar-rupee parity across the open market, grey market, and interbank rates by enhancing documentation and cancelling licenses of non-compliant entities. For the first time, law enforcement agencies (LEAs) and bank officials were apprehended in operations against Hawala and Hundi networks.

Paracha recalled the dire situation two years ago, when the grey market dollar rate was as high as Rs350, the open market at Rs335, and the interbank rate at Rs317. Daily discussions revolved around the possibility of the country’s default and the dollar reaching Rs500/$. Today, the rupee stands stable at around Rs278, a marked improvement.

However, Paracha cautioned against policies that excessively favour export lobbies, referencing the State Bank governor’s statement that $9 billion was purchased last year to stabilise the dollar. He noted, “Without such interventions, the dollar could have depreciated by Rs50, bringing its value down to approximately Rs240, which would benefit the whole country, not just a segment or two of society.”