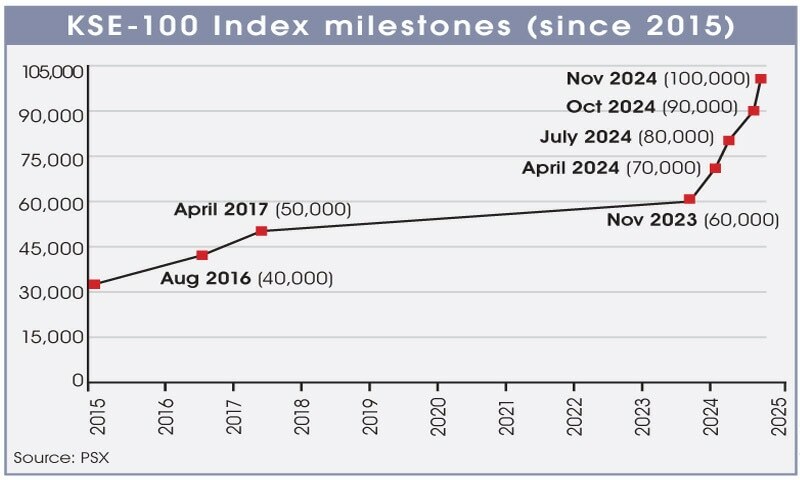

KARACHI: Dominant bulls managed to navigate the Pakistan Stock Exchange (PSX) through turbulent paths to an unprecedented level above 100,000 despite economic, political, and security concerns during the outgoing week.

The unending political instability, rising costs, and deteriorating law and order situation were key worries of big businesses and multinational companies, warning that these issues forced industrialists to relocate their operations abroad.

According to AKD Securities Ltd, the PSX remained volatile throughout the week due to an acceleration in political instability amid the opposition party reaching to protest in the capital, creating uncertainty amongst investors and leading to a record single-day fall in the KSE-100 index, marking a decrease of 3,506 points on Tuesday.

The market regained momentum in subsequent sessions after the protestors started to back off from Islamabad. The bull run was further fuelled by a circular from the State Bank of Pakistan (SBP), removing the minimum deposit rate (MDR) requirements on deposits held by commercial banks of financial institutions and public sector enterprises.

As a result, the KSE-100 index registered its highest-ever single-day gains of 4,696 points on Wednesday.

However, another SBP circular revising guidelines for profit sharing on saving deposits of Islamic Banking Institutions (IBIs) brought Meezan Bank under pressure, eroding 439 points during the week.

According to Arif Habib Ltd (AHL), the key drivers of this recovery included expectations of further easing in inflation and a strong rally in commercial banks following the removal of MDR.

In the T-bill auction conducted during the week, the SBP raised Rs2,494bn, significantly exceeding the target of Rs800bn. This was accompanied by a decline in yields of up to 85bps, with the three-month yield reaching its lowest level since April 2022, and the six-month and 12-month yields falling to levels last observed in March 2022.

Furthermore, SBP reserves increased by $131m to $11.4bn. The rupee marginally depreciated by 0.10pc to Rs278.04 against the greenback.

As a result, the market concluded the week at 101,357 points, marking a gain of 3,559 points or 3.64pc week-on-week.

Sector-wise positive contributions came from commercial banks (1,676 points), technology and communication (349 points), oil and gas exploration companies (284 points), oil and gas marketing companies (260 points) and cement (234 points).

Meanwhile, the sectors that mainly contributed negatively were miscellaneous (52 points), automobile assembler (11 points), and automobile parts and accessories (5 points). Scrip-wise positive contributors were Habib Bank (694 points), Bank Al-Habib (538 points), Pakistan Petroleum Ltd (274 points), Systems Ltd (255 points), and Bank Alfalah (205 points). Scrip-wise negative contributions came from Meezan Bank (439 points), Engro Fertiliser (78 points), Faysal Bank (57 points), Pakistan Services Ltd (56 points), and Sazgar Engineering Works (34 points).

Foreigner selling continued clocking in at $15.1m compared to a net sell of $33.0m last week. Significant selling was witnessed in banks ($4.7m), followed by fertiliser ($4.2m). On the local front, insurance reported buying ($10.6m), followed by individuals ($7.3m).

The average trading volume eased 1.2pc to 979m shares while the average value traded rose 7.1pc to $133m week-on-week.

According to AHL, the market will sustain its positive momentum in the coming week, driven by expectations of a further decline in inflation.

AKD Securities said continuing monetary easing due to the disinflationary environment and improving the macroeconomic environment would make equities more appealing, currently trading at a P/E of 4.9x and dividend yield of 10.2pc. The factors mentioned earlier and declining external financing requirements under the IMF programme would keep foreigners’ interests alive.

Published in Dawn, December 1st, 2024