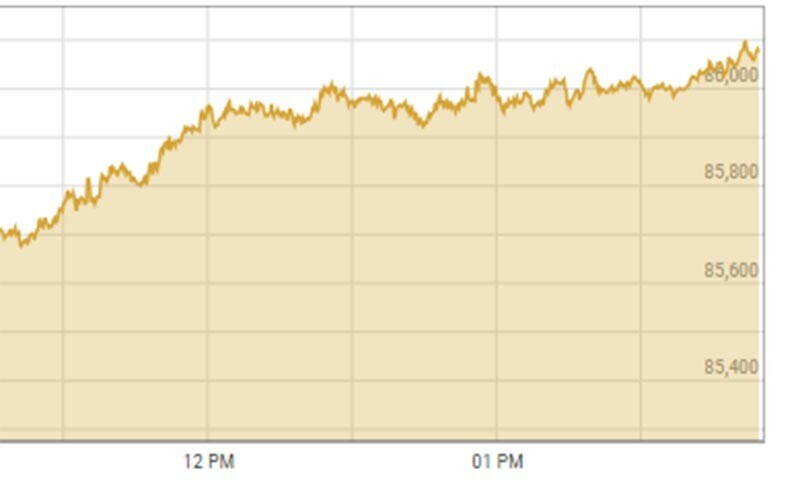

Bulls dominated the trade floor at the Pakistan Stock Exchange (PSX) on Monday as shares gained more than 800 points in intraday trade.

The benchmark KSE-100 index gained 815.22 points, or 0.96 per cent, to stand at 86,065.31 points from the previous close of 85,250.09 at 1:54pm.

Mohammed Sohail, chief executive of Topline Securities, attributed the run to a “reduction in political noise after passing of the 26th Amendment” helping the market to post gains.

The 26th Constitutional Amendment became law earlier today after the approval of both houses of the Parliament.

Pakistani politics saw a second “working weekend” in as many months, where the ruling coalition finally succeeded in passing the much-touted ‘Constitutional Package’ with a two-thirds majority in both the Senate and the National Assembly.

Yousuf M. Farooq, director research at Chase Securities, said, “The market is rerating on the back of declining interest rates.”

“Participants are expecting political noise to subside and economic stabilisation to continue,” he added.

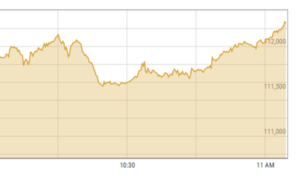

Asian markets mixed as traders digest China rate cut

Asian markets started the week on a mixed note on Monday as traders weigh Chinese central bank interest rate cuts aimed at reigniting the world’s number two economy, while gold hit a record high on geopolitical concerns.

Another record day on Wall Street on Friday was unable to inspire a similar rally at the start of the week, with traders also gearing up for the latest company earnings season.

The People’s Bank of China said it had slashed two key rates to all-time lows as part of a drive by authorities to revive spending and achieve their five pc annual economic growth target.

The move comes after figures last week showed the economy expanded at its slowest quarterly pace since the start of 2023, but still better than forecast.

Zhang Zhiwei, president and chief economist at Pinpoint Asset Management, said: “The monetary policy has clearly shifted to a more supportive stance since the press conference on September 24. The real interest rate in China is too high.”

Friday’s economic growth reading came alongside news that retail sales and industrial output had risen more than expected in September — providing a ray of light after a string of below-par readings on a range of indicators including inflation, investment, and trade.

Beijing has since last month unveiled a raft of measures to revive the economy — and particularly the property sector — including rate cuts, an easing of home-buying rules and pledges to support equity markets.

The announcements inspired a blockbuster rally in mainland and Hong Kong stocks, but some of those gains have been erased after a series of disappointing news conferences that failed to provide any detail or meaningful measures.

“Officials are gradually ramping up support to kick-start the economy — but the will-they-won’t-they of announcements has made the process a rollercoaster for markets,” said analysts at Moody’s Analytics.

“The latest supports are very welcome. And they’re likely to propel the economy to its ‘around 5’ pc target for the year. But more is required if officials are to address the structural challenges in the economy.” Hong Kong tumbled after clocking up a more than three pc gain Friday, but Shanghai edged up.

Tokyo, Singapore, Manila, Bangkok and Mumbai also fell, with Sydney, Seoul, Wellington, Taipei and Jakarta rising.

London advanced, but Paris and Frankfurt both fell.

Investors had been given a positive lead from Wall Street, where the Dow and the S&P 500 pushed to fresh records, helped by strong earnings from Netflix and positive reports on Apple’s iPhone sales in China boosted the massive tech sector.

Safe-haven gold prices hit an all-time high of $2,732.82 on news that Israel was discussing its retaliation against Iran after Tehran’s missile barrage this month, while news that a Hezbollah drone exploded near Prime Minister Benjamin Netanyahu’s home stoked tensions.

Oil prices rose, having tumbled more than eight pc last week as uncertainty over the economy in China — the world’s top importer of the commodity.