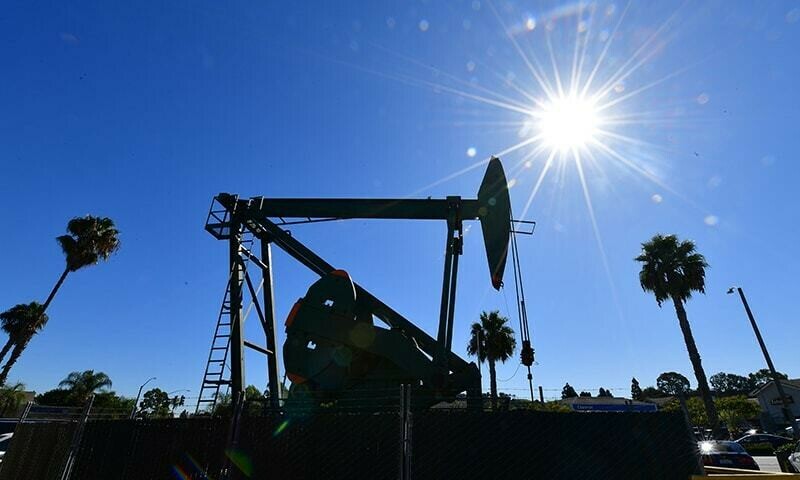

LONDON: Oil rose above $80 on Monday on Middle East tensions while equities slid in New York as political and interest rate concerns dented the recent rally.

Brent North Sea crude, the international benchmark oil contract, went above $80 per barrel for the first time since late August.

Oil futures have experienced recent volatility, with Brent slumping under $70 last month on concerns about weak demand before intensified fighting in the Middle East sent prices soaring 10 per cent last week.

Israel is preparing its retaliation against Iran over its missile attack last week, raising fears of an all-out regional war that could involve strikes on oil facilities.

Beyond Middle East tensions, oil is also being supported by hopes of stronger Chinese demand after Beijing recently announced major stimulus measures to boost its flagging economy.

Offsetting price support is an expectation in the market that the Opec+ group of oil-producing nations could reverse output cuts, according to analysts. “The oil market is on a wild ride, caught in a whirlwind of geopolitical tension, Opec+ strategy shifts, and a slowdown from its biggest customer, China,” noted independent analyst Stephen Innes.

The rising oil price and concerns about the Middle East put an end to a recent rally on world stock markets.

“Wall Street is on a four-week win streak but (is) under pressure from rising yields, a rally in crude oil, and a strong dollar amid geopolitical and inflation concerns,” said Joe Mazzola, a strategist at Charles Schwab.

Published in Dawn, October 8th, 2024