In the world of startups, attention spans are usually short-lived, just like the apps they build out. One day, you’d be a star, getting media attention left right and centre, speaking at conferences and being named in the Forbes 30 under 30. The following month, you could be facing legal proceedings on charges of fraud.

Yet, one company has managed to keep everyone hooked for close to two years now; perhaps this is actually OpenAI’s biggest achievement so far and not GPT. After launching the chatbot, it became the fastest startup to hit a billion users, and even faster in abandoning the non-profit ethos.

Last week was more of the same.

First, chief technology officer Mira Murati, along with two other executives, left the company, continuing the leadership exodus. However, shortly after, OpenAI raised $6.6 billion in fresh funding at a valuation of $157bn, becoming the third most valuable venture capital-backed entity on the planet. Only SpaceX and TikTok parent, ByteDance, are worth more.

The Pakistan venture capital market remains unmoved as distant foreigners and uninterested local capital leave few options for startups

However, OpenAI’s round — the largest in history — is not representative of the broader venture market where global funding fell to $70.1bn in Q3FY24, according to Pitchbook data. This is the lowest amount since October-December of 2017 and represents a decline of 22.6 per cent over the same period last year and 26.6pc compared to the preceding quarter.

Apart from North America, where funding rose 11.9pc year-on-year (YoY), all other regions saw further pullback. The decline in Asia was particularly steep as the amount nosedived 51.4pc to $14.9bn in July-September, receding to levels not seen since the start of 2016 and barely 21pc compared to the peak of Q4FY21.

Volumes were no more immune either, as the number of deals plunged to just 7,227 in Q3FY24, the worst-ever quarter since at least 2015. Even if you add the estimated rounds, the total increases to 9,742 and barely reaches the Q3’19 levels. This slide is quite broad-based as every single region saw a dip in the deal count, again led by Asia at 31.6pc year on year.

Similarly, exit activity also remained muted at a total dollar value of $39.2bn across 606 deals in Q3FY24 — down 55.6pc and 17.8pc, respectively, compared to the same period last year. Surprisingly, Asia stood out here, and not for the wrong reasons. It accounted for 45.6pc of the exit value, probably led by some big listings in India, where the public markets have been surprisingly buoyant over the last few years.

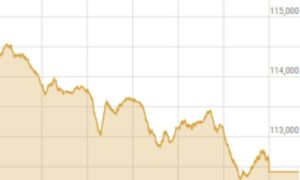

While Pakistani markets have also enjoyed good momentum over the last 12 months, rallying 29.2pc in 2024 so far, the venture market remains unmoved. Between January and September, Pakistani startups have raised a grant sum of just $16m, according to Data Darbar. But, if there’s any consolation, four deals worth $15m came during the last quarter alone. If you add Myco, which is technically headquartered in Dubai, the aggregate increases by another $10m.

Regardless, for a country our size, these are quite insignificant numbers. Obviously, the biggest reason behind that is most of the funds who have invested in Pakistan are foreign, and don’t really take a view of the local market out of any long-term strategy. The local capital is virtually non-existent — a problem that’s unfortunately not limited to only venture capital.

This combination of distant foreigners and uninterested local capital leaves few options for startups. Debt has always been scarce, venture capital has become increasingly difficult, and subsidised government-backed financing is unreliable. Amidst such doom and gloom, the upcoming release of Shark Tank Pakistan could be a much-needed addition to the ecosystem and open up some opportunities for entrepreneurs.

As seen in other markets, including neighbouring India, the show has the potential to bring much-needed attention and excitement to entrepreneurship, possibly inspiring a new generation of founders. More importantly, it can possibly bridge the gap between investors and startups, opening up access to capital that has been severely constrained in recent times.

Furthermore, it can help educate the general public about the startup world, potentially expanding the pool of angel investors and creating a more supportive environment for entrepreneurship. From a purely fundraising perspective, the scale is likely going to be quite small, as seen in India, and no match to venture. But, if it helps highlight some lesser-known success stories, that would be good enough of a win because God knows we need them.

The writer is the co-founder of Data Darbar

Published in Dawn, The Business and Finance Weekly, October 7th, 2024