KARACHI:

Pakistan Stock Exchange (PSX) enjoyed significant gains on Tuesday as the KSE-100 index surged over 650 points in a rally driven primarily by upbeat remittances data, which showed a 40% year-on-year (YoY) rise at $2.9 billion in August 2024.

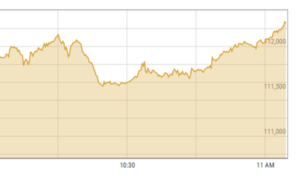

Owing to losses in the prior session, the trading day had a lacklustre start, when the index hit its intra-day low at 78,642.86 points. It lingered near that level for most of the session until a robust rally later in the afternoon sent it soaring.

The spike was triggered by not only the inflow of remittances but also by the finance ministry’s commitment to institutional reforms as part of a new International Monetary Fund (IMF) loan programme.

Investor sentiment was further bolstered by speculation surrounding the State Bank of Pakistan’s (SBP) policy rate announcement on September 12, with many anticipating a reduction.

Surging exports and optimism about bridging the external financing gap further fueled the market’s rise. Consequently, the index crossed the 79,000 mark and reached its intra-day high at 79,335.59 points. It closed near that level with impressive gains. “Stocks closed bullish amid upbeat data of remittances that surged 40% YoY to $2.9 billion in August and finance minister’s commitment to institutional reforms for the IMF programme,” said Ahsan Mehanti, MD of Arif Habib Corp.

“Speculation about the SBP policy rate announcement on September 12, surging exports and expected resolution of the external financing gap issue also played the role of catalysts in positive close at the PSX.” At close, the benchmark KSE-100 index posted notable gains of 671.73 points, or 0.85%, and settled at 79,286.74.

Topline Securities, in its review, said that the market’s upward momentum was driven by institutional buying of blue-chip stocks.

Key heavyweights such as Engro Fertilisers, United Bank, Bank Alfalah, Lucky Cement and Habib Bank posted significant gains, collectively contributing 367 points to the KSE-100 index, it said. Investor interest was notably strong in the cement sector ahead of the monetary policy meeting on September 12, where a rate cut was widely expected, Topline added.

Arif Habib Limited (AHL), in its report, wrote that the KSE-100 finally punched through 79,000 following participation of cement stocks.

Some 68 shares rose while 28 fell with Engro Fertilisers (+2.99%), United Bank (+1.93%) and Bank Alfalah (+5.46%) being the biggest index contributions, it said, adding that DG Khan Cement (+2.15%), Fauji Cement (+3.03%), Lucky Cement (+2.64%), Maple Leaf Cement (+2.39%) and Pioneer Cement (+2.8%) were the notable performers among top-tier cement names.

JS Global analyst Mubashir Anis Naviwala observed that the market opened on a positive note and maintained its upward momentum, with the KSE-100 closing at 79,287, up 672 points.

“Going forward, we recommend investors to adopt a buy-on-dips strategy with particular focus on cement, automobile and technology sectors,” the analyst added.

Overall trading volumes increased to 509.5 million shares compared with Monday’s tally of 491.1 million. The value of shares traded during the day was Rs13.8 billion.

Shares of 436 companies were traded. Of these, 202 stocks closed higher, 170 dropped and 64 remained unchanged.

WorldCall Telecom was the volume leader with trading in 117.01 million shares, gaining Rs0.06 to close at Rs1.52. It was followed by Kohinoor Spinning Mills with 57.1 million shares, gaining Rs0.43 to close at Rs10.06 and Agritech Limited with 18.2 million shares, gaining Rs3.21 to close at Rs35.31.

During the trading session, foreign investors sold shares worth Rs361.8 million, according to the NCCPL.